First off, I encourage you to follow my work. Please click here to sign up for real time alerts on my articles (at the top of the page near my name select "get real time alerts")

Spread a link to this article everywhere you can because this stock DESERVES coverage.

One new endeavor that I have embarked upon is searching for

small-cap biotech names that may have significant upside with limited downside.

Several factors are at play to identify such a company and there are substantial

risks in picking the wrong company. There are several ways one can do this. The

methodology that I am employing is certainly not perfect, but can definitely

point the needle in the direction that a company's stock should move. The first

thing I am looking for is recent price action. Has the stock been on a tear that

is warranted? Is it rising but just on speculation and likely to crater? Is the

stock dropping and if so, is it warranted, or is it overblown? Next I look to

the company's most recent quarterly performance. How is the year-over-year

change? Is the company making investments? Are there revenues? The next item on

this list is to examine a company's product pipeline and/or its deals/contracts

it has made. Logically, I next look into the company's financial status.

Finally, while I never believe in investing on this concept without having the

fundamentals in place, I look at the potential for a takeover as well as any

insider information. Employing this methodology, for the month of August I have

identified what I believe to be a laughably undervalued company that I have

covered in brief in the past. I have also invested personally in the company

based on this analysis. This company is Response

Genetics (RGDX).

Who is Response Genetics?

According to the Yahoo Finance description, this biotech company is

engaged in the research, development, marketing, and sale of pharmacogenomic

tests for use in the treatment of cancer primarily in the United States, Asia,

and Europe. Clearly, this is a market that is growing and the technology is in

high demand. The company develops genetic tests that measure predictive factors

for therapy response in tumor tissue samples. The company offers tests for

non-small cell lung cancer, gastric and gastroesophageal cancer, melanoma and

thyroid cancer, and breast cancer patients' tumor tissue specimens. Its most

popular products include its ResponseDX line to detect lung, colon, gastric,

melanoma, thyroid and breast cancers. It also provides products to detect

specific genetic mutations. This includes HER2 mutation detection, cKIT mutation

detection, MET gene amplification, and UGT1A1 SNP tests, including ROS1 FISH,

ROS1 RT-PCR, c-MET, HER2 FISH, and VEGFR2.

Where some of the most exciting growth exists is that the

company is now focusing on the development of various diagnostic tests for

predicting therapy response and determining the diagnosis and prognosis of solid

tumors in cancer patients. Now that you have a basic understanding of its

portfolio of products, let's discuss why I believe the stock is absurdly

undervalued.

Criteria 1: Price Action

Well, to be honest, I almost passed over Response Genetics

based on its chart. In fact, the action has been pretty ugly as shown in figure

1. The stock has steadily declined in the last year, with sudden spikes in

prices scattered about. If one believes in "being due" in a rebound well, that

time is probably upon us. More realistically, the stock has seemed to stabilize

in the mid $0.60 range on high volume. That is a positive sign for a reversal.

Here we have a stock that has fallen from $2.93 and valued at $110 million to

its current levels, at just above all-time lows at $0.65 and valued at only $25

million. Wait a minute? Am I really about to recommend a stock that is at

all-time lows? Well yes, because we have a sum of the parts situation here. The

fact of the matter is the company is undervalued, and a rebound is inevitable.

There is just too much going for this company that the risk/reward ratio is just

too far skewed. I believe this stock has 100% plus upside and no more than a 20%

downside. Let me reiterate, there is a 5 to 1 (probably more) ratio here.

Hopefully I have your attention. I want to point out that the selling has been

driven nearly entirely by retail investors. The stock has decent volume given

its small cap status around 150,000 shares per day. But there simply are not big

names involved in this stock, at least not yet. But does the company even have

revenues?

Figure 1. Share Price of Response

Genetics Over The Last 52 Weeks

Criteria 2: Quarterly

Performance

It is important to note that in a sector like this, the

whims of the market can cause quarterly sales and earnings to fluctuate wildly

based on the company's customers' patient volume, inventory etc. Let's discuss

the recent quarterly earnings. For the first quarter of 2014, Response Genetics'

total revenue was $3.9 million compared to $4.8 million for the quarter ended

December 31, 2013 and $5.6 million for the quarter ended March 31, 2013. The

company's ResponseDX line of products revenue increased approximately 4% over

the quarters ended December 31, 2013 and March 31, 2013 to $3.3 million.

ResponseDX product volume, or samples processed, also increased over the quarter

ended December 31, 2013. If it is not evident, the decrease in total revenue

came solely from pharmaceutical client revenue, which has always varied

significantly on a quarterly basis.

The Q2 2014 report has me excited. Clearly the company is

now moving in the right direction. According to the report total revenue was

$4.3 million compared to $3.9 million for the first quarter 2014, a 10%

increase. The decrease in total revenue year-over-year "came solely from

pharmaceutical client revenue, which can vary significantly on a quarterly basis

by its very nature and concentration". Additionally, second quarter 2013 pharma

revenue included a $500,000 GlaxoSmithKline (GSK) milestone payment. Here is where it gets exciting. The

ResponseDX suite of products saw record revenues of $3.7 million, an 18%

increase over the comparable 2013 quarter and an 11% increase over the quarter

first quarter of 2014. This was in large part due to the rise volume of samples

processed. ResponseDx sample volume rose also i 16% over the first quarter. In

addition, the company notes that total pharmaceutical revenue increased 4%

quarter-over-quarter. In reference to the quarter, CEO Thomas Bologna was quite

bullish as he stated:

"We are especially pleased with the continued growth in both our DX revenue and unit volume which again increased over the immediate prior quarter. Second quarter DX revenue set a record for the Company's quarterly DX sales. We believe that our record quarterly ResponseDX revenues indicate that the efforts made over the past two years are taking hold. Additionally, we expect our future pharma revenues to begin benefiting from the launch of testing services related to initiatives and activities that we have in place. We expect 2014 could be a transformational year for our Company in many respects, not the least of which is we expect both ResponseDX unit volumes and revenue to continue to increase as a result of the initiatives and infrastructure that we implemented over the last two years."

So, why do I think $25 million is absurd for the valuation

of this company? If we ball park average quarterly revenues at say $5-$6

million, that would mean that the entire company is only worth 4 to 5 quarters

of sales. For a large cap company, this might make sense. In the biotech world

this is a little light, considering the potential the company has. To me, the

parts are worth more than the whole. It is intriguing, but then I thought maybe

that the selloff and reduced sales were because the company is dying. This could

not be further from the truth. On the whole, the company is growing long-term,

but the short term has been painful.

Criteria 3: Product Pipeline/Contracts

and Deals

Clearly the company needs growth to resume its share price

appreciation and reverse the nearly 60 percent haircut the

stock has taken in just over a month, sending its market cap to the absurd

levels it is at for the amount of sales the company currently has and the growth

of its ResponseDx line. What do I mean when I say this? Well to me, for a

company that is generating about $5 million in sales per quarter, while new

contracts which I am about to discuss are just starting to take hold, I view a

$25 million market cap as laughable. With a 17% growth in the flagship line of

products and the CEO now calling for higher revenues in the coming quarter, in

my opinion, the shares are setting up to move higher. I have seen many more

companies with no revenues and a higher cash burn rate (see below for cash burn)

trade at valuations several of orders of magnitude higher. Further, on the conference call for Q2, CEO Thomas Bologna

essentially indicated that the company was undervalued and shared in the

frustration with the recent share price. Further, he indicated there would be

news on a major pending deal in several weeks, as well as news on a contract

with New York State in September.

Aside from the information from the recent Q2 earnings call,

when I recently covered that company as a potential takeover

target for one of my other holdings, Quest Diagnostics (DGX), I looked into Response's pipeline and I found good news.

Strikingly good news. The company is growing. It is making deals and has

significant products in its pipeline. One huge piece of news was that Response Genetics signed

agreements with six health plans across 10 states bringing Response Genetics'

total national contracted membership to more than 174 million lives.

As I alluded to in the potential takeover article, having

access to these 174 million lives means that the sales potential, that is, the

potential market in the years ahead, simply cannot be understated. Why is this?

Well surely not everyone will need a diagnostic test for cancer. But it widens

the potential market for sales. While there may not be an immediate impact, it

will most certainly lead to more testing volume. This was evidenced by the

quarter-over-quarter volume growth in ResponseDx testing. I expect this growth

to continue. So where exactly are these new agreements which expanded the total

potential market. The new agreements include additional Blue Cross Blue Shield

contracts in, Pennsylvania, Delaware, West Virginia, Arizona, Iowa and South

Dakota. The company also signed new agreements with an independent physician

association across two states in the north-west region and a commercial health

plan in the north east region of the United States. Ok great. So what does it

mean? Well, the company is now in-network with a total of thirteen Blue

Cross/Blue Shield health plans, which brings the total number of those in the

Blue Cross Blue Shield plans with direct access to Response Genetics products to

approximately 23 million. Let that sink in for a moment.

Looking solely at the so-called "Blues" you are telling me

the company is only worth $1.08 per potential customer in the so-called "Blues"

alone? Extrapolating to the 174 million lives that Response has access to, the

absurdity of the share price becomes evident, in that the company is only worth

$0.14 per potential customer. Maybe I am being a bit dramatic, but this is

incredibly striking. Of course, let's be realistic. Not every one of these

individuals is going to need a cancer diagnostic or other molecular test.

Further, there are other companies in this game (see risks section below), and

so not every potential customer would necessarily be given a test offered by

Response. However, the potential market for Response's products has now widened

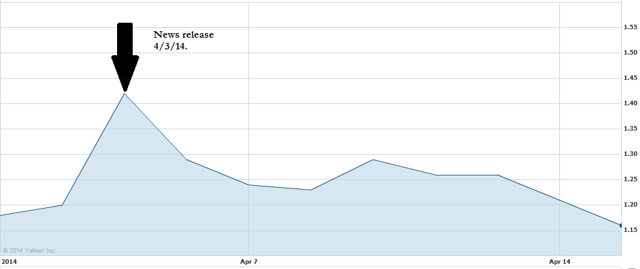

significantly. And traders took note as what was incredible to note was the

massive spike on high volume following the news, but was more surprising was

that the stock to gave it all back and then some over the course of the next

week (figure 2). Since that spike into the $1.40's the stock has lost 60%.

Figure 2. Trading Action in Response

Genetics Stock Following The Announcement of Contract With Six New Health

Plans/

But domestic growth is not the only good news my review

identified. The company is now doing business outside the United

States. Response now has a commercial agreement with DxM Diagnostico

Molecular, a leading distributor for cancer testing in Mexico. Per the contract

Response Genetics will provide its suite of ResponseDX testing services to

patients throughout Mexico. The agreement specifically covers the ResponseDX:

Tissue of Origin test. Further, the agreement allows DxM Diagnostico Molecular

access to a number of other targeted molecular tests in the Response Genetics

portfolio. This is key. On the news this was occurring, the stock spiked only to

lose it all and more following the news.

Are there any new products? Well yes. Response recently announced the availability of new testing

capabilities to advance cancer immunotherapy development for clinical use. The

new Immuno-Oncology assay which the company has created is designed to measure

the RNA expression of 26 commonly investigated immunotherapy related genes

enabling screening for response to immunoregulatory pathways.

The new Immuno-Oncology test is currently being made available to all of Response Genetics' existing

biopharmaceutical partners, and new potential partners, to aid in

development of biomarker driven cancer immunotherapy clinical trials. Please

allow me to wear my epidemiologist hat for a moment. Those familiar with this

field may know that as referenced by CEO Thomas Bologna when discussing the new

product, that a significant number of clinical trials being conducted by the

largest pharmaceutical companies are focused on signaling pathways with the goal

of enabling the immune system to attack cancer cells. Response Genetics' new

assay covers many of these pathways as well as numerous other targets.

Criteria 4: Financial Status: The good

and the bad.

Besides the incredible fundamental growth the company is

undergoing, the financial status helped put this stock as one of my top

recommendations. Because the company is still growing and making huge

acquisitions, it is burning through a ton of cash right now. Even though the

company has significant revenues, it spends a lot to operate research and

development activities, as well as corporate and other expenses. A poor choice

that would have harmed shareholders would have been a dilutive secondary

offering, as one was recently conducted in December 2013. Response Genetics instead went

with securing credit. Response Genetics secured a revolving $12 million credit

facility. This is huge. This is approximately 50 percent of its current

market cap as an available loan. Further, it does not dilute shareholders, at

least immediately. The creditor SWK Holdings has given $8.5 million, and the

remainder can be drawn when Response hits predetermined revenue milestones. What

is more, SWK Holdings received warrants to purchase over 600,000 shares at

$0.93, a 43 percent premium to the current price. I believe that the company is

healthy, or else they would NOT have received this loan, even with a 12.5%

interest rate. Think about it, do you loan money to those who you think would be

unable to pay the loan back?

But it is not all great news. A truly health company would

be able to thrive on its own revenues. While the credit facility is not dilutive

in the immediate like a secondary, it can have negative consequences despite

providing much needed cash. First let me discuss the credit facility. The 12.5%

interest rate is not insignificant. A hefty portion of cash flow from operations

will go to paying interest. Clearly the company (and the creditor) are expecting

revenues to increase in the future. But Response has had a significant cash burn

rate. As the

company grows, it is losing money. Its research and development expenses

were approximately $297,200 and $467,000 for first quarter 2013and 2014,

respectively, representing 5.3% and 12.0% of its net revenue for these time

periods, respectively. Where does it go? Most of it is spent on supplies and

reagents personnel costs, occupancy costs, equipment warranties and service,

insurance, business consulting and sample procurement costs. As the company

ramps up you can probably expect research and development expenses to increase.

That is a negative. These costs pale in comparison to the selling and

administrative expenses, which in the first quarter were nearly $4.47 million.

Considering revenues were only $3.9 million, the losses are not insignificant.

As of the end of last fiscal year, the company had just over $8 million in cash

and equivalents. After posting a loss of $3.5 million for the first quarter, the

company would have been cash starved by year end 2014 if not sooner. I will

point out however that revenues are expected to rise for the rest of the year,

as they did in the second quarter, which should offset the cash burn rate to

some degree as the company rolls out its new products and serves new customers

this year. Despite higher revenues around the corner, which I expect to drive

the share price higher, I believe that another secondary offering which would

dilute shareholder equity is not out of the question, perhaps as early as late

2015. The only positive news associated with this possibility is that the share

price will likely have rebounded, for the fundamental reasons associated with

the company's organic growth I have outlined here. Finally, the company under

its credit facility agreement, can request an addition $3.5

million in funding in 2016, provided it has stayed current on its quarterly loan

payments and has grown revenues to the creditor's satisfaction.

Criteria 5: Other positives, including

takeover potential

Clearly I believe the company is significantly undervalued

and is offering a lopsided risk/reward ratio. While we cannot judge a stock

based on where it has been, given the expansion of the product lines and new

contracts, revenues are expected to rise. Some key metrics that should be pointed out is that the price to

sales ratio has come down to very favorable levels, currently at 1.33. While

this is just one metric, it is very useful for early stage companies like Response

that have revenues but are not profitable. The 1.33 price-to-sales ratio is

quite low compared to some of Response's peers, including the larger Genomic

Health (GHDX) which has a price-to-sales ratio of 3.1. In contrast, the

stronger Quest Diagnostics, which I believe could easily gobble up Response, has

a price-to-sales ratio of 1.22, but can also be evaluated by other metrics since

it turns a profit.

As I opined in June, the company is likely a takeover target

for a larger diagnostics company that would want to acquire instant growth at a

significant discount. I think Quest is the likely takeover initiator given its

size and need for its own growth. Just 6 months ago, the buyout at minimum would

have been for $1.50-$2.00 a share, and likely over $3.00. Now, the board would

be hard pressed to turn down an offer over $2.00 a share which would offer a

200% plus premium. I am not opining a buyout is evident. But it is certainly

possible.

Response also has one other thing going for it. Many

insiders, including the board, were recently awarded options valued at $0.88. Surely these

insiders would not sell their awarded shares below this level. As such, $0.88

represents a 35 percent upside. That is my absolute minimum

upside target from the current levels of $0.65.

Risks

As with any early stage company, there are significant

risks. As I alluded to above, the company has a high cash burn rate. It had

conducted a secondary back in December 2013 and is now borrowing money. With its

$5 million in cash on hand plus the $8.5 million it has just acquired, I project

that given an average $3 to $4 million loss per quarter, the company has cash to

last at least into late 2015. But with the new contracts in place, revenues are

anticipated to rise. An exact estimate cannot be provided as it all depends on

orders, patient volume etc. However, it is clear more customers are on the books

as are more products. With earnings due out this week, we will have a better

picture of the health of the company for me to follow-up on. I anticipate a loss

of another $3.5 million.

Competition is stiff. Response's two main competitors have

been referenced in this article. Quest Diagnostics, who is king of the ring for

lack of a better analogy, and the smaller (but much larger than Response)

Genomic Health. Both Quest and Genomic Health beat on earnings. This could mean that

Response may also see increased numbers, or may mean that these competitors are

taking market share. Further, the way Response is being reimbursed for many

tests is changing (which is likely impacting its competitors.

Each test the company performed relates to a specimen

derived from a patient, and received by the company on a specific date (such

encounter is commonly referred to as an "accession"). The company's services are

billed to various payers, including Medicare, private health insurance

companies, healthcare institutions, and patients. The company reports net

revenue from contracted payers, based on the contracted rate, or in certain

instances, the company's estimate of the amount expected to be collected for the

services provided. For billing to Medicare, the company uses the published fee

schedules, net of standard discounts. The company analyzes historical payments

from payers as a percentage of amounts billed by the company to estimate

expected collections for purposes of recording net revenue. Now here is a

problem, the Federal Government is trying to save money, which could impact

Response's revenues. According to the most recent 10-Q:

"On July 8, 2013, CMS released a new proposed rulemaking entitled 'Medicare Program; Revisions to Payment Policies under the Physician Fee Schedule, Clinical Laboratory Fee Schedule & Other Revisions to Part B for CY 2014'. This proposed rule contains a number of provisions that may adversely impact the level of reimbursement for a variety of tests for which the Company receives reimbursement from the Medicare program. Among other things, CMS has proposed examining approximately 1,200 laboratory tests that appear on the Clinical Lab Fee Schedule ("CLFS") over a period of five years to determine whether advances in technology may have reduced the cost of providing such tests and whether or not the level of reimbursement should be revised. The Company is currently performing molecular testing which is reimbursed using CPT codes that fall on the CLFS. CMS has also proposed changing the methodology used to determine reimbursement rates for the technical component of certain tests reimbursed off of the Physician Fee Schedule ("PFS")."

A number of proposals for legislation or regulation continue

to be under discussion which could have the effect of substantially reducing

Medicare reimbursements for clinical laboratories or introducing cost sharing to

beneficiaries. Depending upon the nature of regulatory action, if any, which is

taken and the content of legislation, if any, which is adopted, the Company

could experience a significant decrease in revenues from Medicare and Medicaid,

which could have a material adverse effect on the Company. The Company is unable

to predict, however, the extent to which such actions will be taken."

Given that Medicare is a large source of revenue from

testing, this is a fundamental risk to the company's revenues, and is also a

risk shared by the larger Genomic Health and Quest Diagnostics. However, given

that Response is a smaller company, every single cent matters to his company,

especially if it wishes to avoid a dilutive secondary. Despite these risks

however, the company continues to expand its potential market and sign new

contracts. The impact of any regulatory changes cannot be predicted at this

time, but clearly they will be designed to pay out less tax payer money to

companies such as Response.

Conclusion

All things considered, I think it is hard to argue that

Response Genetics is somehow fairly valued. The recent action has been driven by

panicked retail investors, who in my opinion are afraid of the chart. There are

inherent risks. The company trades wildly on company releases, often to the

upside. But the fundamentals of the company seem to be improving, despite its

cash burn rate and the risk to reimbursement. On a technical basis, the price

has been stabilizing in the $0.60 range. As Response Genetics has now secured

funding, has expanded to 13 hospital/physician/insurance networks, is selling

products internationally, has access to over 174 million lives potentially, has

exciting products in the pipeline and has multiple contracts in negotiations

according to recent conference calls, I think the stock is offering

incredible upside potential given that revenues are projected to rise, while the

downside risk, at current levels, is minimal. I reiterate that I believe for

patient investors there is a 100% plus upside, with 20% downside risk.

The "20% downside" from 0,60 cents became a raw reality to 0,25 cents or so....more like a 60 %.....

ReplyDeleteSeems like it is recovering now a little in the fifty area....

I enjoy your articles very much though.......when is the next about RGDX?

Thanks.